Thousands of companies are shutting ahead of this week’s Budget, which financial consultants are afraid will definitely complete as much as among the many most vital firm tax obligation raids of the modern-day interval.

The Chancellor has truly proclaimed her maiden financial declaration will definitely “grow the economy” and attract monetary funding proper into Britain.

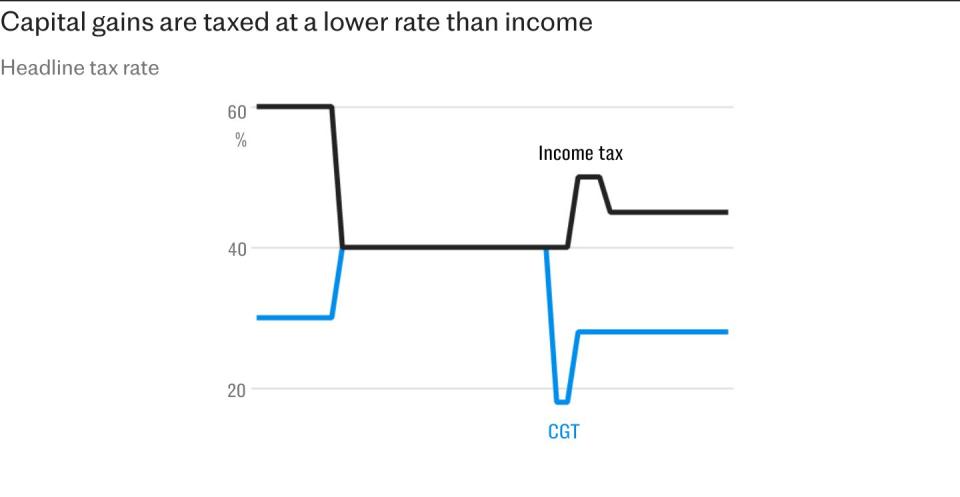

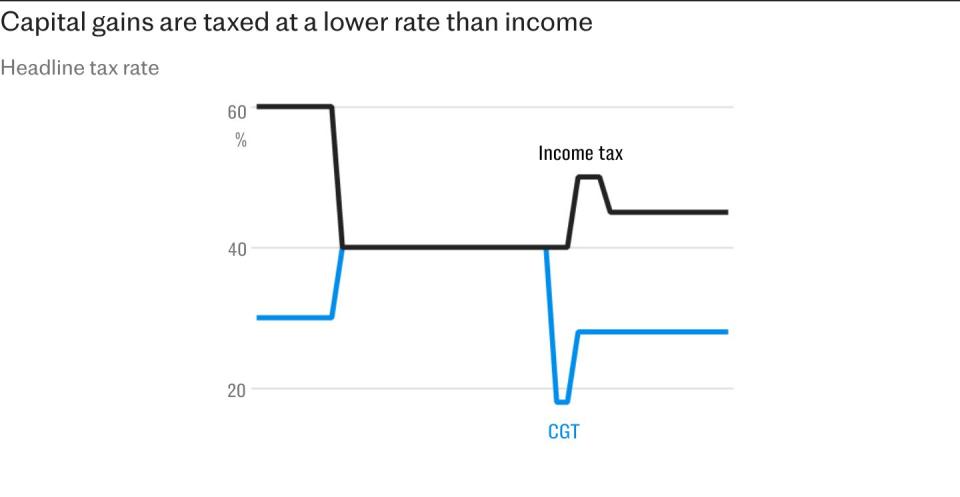

Figures reveal there has truly been an increase within the number of business owners shutting up shop amidst in depth fear Rachel Reeves will definitely rob funding positive aspects tax obligation to finish an effort to raise ₤ 40 billion.

More than 1,600 agency supervisors have truly chosen to calm down their companies to date this month, which is certainly the best number of closures this 12 months and better than double the amount for all the of final October, in keeping with notifications submitted to The Gazette.

There has truly been a considerable surge in service closures as a result of August, when Sir Keir Starmer alerted the celebration’s very first Budget would be “painful”.

Ms Reeves is readied to introduce a significant increase to employers’ national insurance by as excessive as 2 p.c components along with making a lower to the incomes limits at which corporations start making nationwide insurance coverage coverage funds. The steps are readied to raise as excessive as ₤ 20 billion, standing for “one of the biggest tax raising measures of modern times”, in keeping with the Institute for Fiscal Studies (IFS).

Anna Leach, the first monetary skilled on the Institute of Directors, acknowledged there’s “huge frustration and huge disappointment” amongst magnate ahead of the Budget, that basically really feel Sir Keir “said he understood businesses, but clearly doesn’t”.

She included: “How can we be positive that the Government will be interested in actual stability rather than cheap political wins?”

Caroline Sumner, the president of R3, a career group of chapter and restructuring corporations, acknowledged her individuals from all through the UK have truly seen an increase in queries.

“There are concerns about budget implications and tax rises in the Budget so they are seeking to avoid that by bringing their plans forward,” she acknowledged.

The ready for raid on funding positive aspects tax obligation, which could see firm proprietor along with buyers exhausted at a better value, along with changes to the non-dom regime, have truly presently been condemned for urgent millionaires proper into leaving Britain.

The Chancellor is anticipated to increase the adhere income tax obligation limits, a supposed “stealth tax”, which will surely drag numerous people proper into paying better tax obligation costs, along with ending property tax exceptions for companies and farming land.

She will definitely likewise revise financial tips to launch a loaning spree of roughly ₤ 50 billion, a relocation that professionals state will definitely trigger charges of curiosity remaining better for longer and run the chance of rising the speed of dwelling mortgages.

Last night, a number one Labour benefactor acknowledged that rich people threatening to flee Britain to forestall tax obligation will increase must “f— off”.

Dale Vince, the millionaire eco-friendly energy mogul, really useful the nation will surely be a lot better with out these getting ready to go away the UK as quickly as Ms Reeves elevates tax obligations on this month’s Budget.

“If people only live here because they pay less tax, they should f— off,” he knowledgeableThe Telegraph “This is a brilliant country. There’s no way people won’t live here because of a fairer tax system.”

Sir Keir and Ms Reeves have truly repetitively assured they will surely not pressure “working people” but in present days preachers have truly battled to specify what they suggest by a functioning particular person.

Carl Emmerson, the alternative supervisor on the IFS, acknowledged: “I don’t think there is a tax rise you can do, which wouldn’t lead to someone in paid work losing out.”

He included that compeling corporations to boost their nationwide insurance coverage coverage funds will definitely make it additional pricey to make use of people and “will be felt in wages eventually”.

“The theory and the evidence is that it will lead to lower wages,” he acknowledged. “That will dampen growth in the short term. And in the longer run people might be less inclined to work longer hours – that is how you get a negative effect in a sustained way on growth.”

Craig Beaumont, the chief supervisor of the Federation of Small Businesses, acknowledged the rise to employers’ national insurance will definitely make “almost every job in the private sector more expensive” and is prompting Ms Reeves to disclose an increase to firm allocation to assist the strike.

The number of companies submitting notifications for volunteer liquidation– implying supervisors have truly chosen to finish up a enterprise as a substitute of being bought to take action by a court docket on account of insolvency– climbed to an annual excessive of better than 1,600 this month, in keeping with a Bloomberg analysis of notifications submitted in The Gazette.

Edwin Kirker, a London- primarily based liquidator, acknowledged he had truly seen a rise within the number of firm proprietor wanting to finish up prematurely of the Budget.

“There’s a raft of them that have been coming through in the last couple of months ever since everyone began assuming the Government would increase inheritance tax and capital gains tax,” he acknowledged.

A HM Treasury spokesperson acknowledged: “As the Chancellor made clear at the International Investment Summit in London: when we said we would end instability, make growth our national mission and enter a true partnership with business, this government meant it. We do not comment on speculation around tax changes outside of fiscal events.”

&w=1068&resize=1068,0&ssl=1)