- ASX topples significantly on duties and earnings miss out on

- Fortescue, monetary establishments and Super Retail dive; Whitehaven, Telstra surge

- Whitehaven, Telstra amongst the champions

The ASX rolled significantly on Thursday, down 1.3%, continuing the place it ended the opposite day.

There’s plenty of elements for the massacre.

First, the January duties report from the stomach might be present in hotter than anticipated, with 44,000 duties included within the financial local weather in January.

On paper, that seems wonderful, nonetheless it pressed bond buyers to decrease their financial institution on any form of hopes of an extra RBA charges of curiosity decreased in May.

Secondly, earnings interval stays in full pace, and some of the large cap names merely actually didn’t create the objects.

Banks copped a dangerous as soon as extra, with Australia and New Zealand Banking Group’s (ASX:ANZ) down over 3% after it uncovered a rise in broken funds, which is dragging down the complete monetary market.

Fortescue (ASX:FMG) likewise obtained wrecked, down 7% after a harsh 53% income lower for the fifty p.c yr. Despite doc iron ore deliveries, earnings from hematite tanked 21%, bills soared 8%, and due to this, appearing reward obtained minimize by over fifty p.c.

Magellan Financial Group (ASX:MFG) had a harsh session, its shares dropped 9.5% after the enterprise’s income stopped by 10% within the fifty p.c. The enterprise said it was analyzing its annual report after introducing the go to of Dean McGuire as its brand-new CFO.

Goodman Group (ASX:GMG) introduced the residential property market down after dropping by over 6% on introducing a $4 billion funding elevating to enhance its consider info centres. It’s been 12 years contemplating that the enterprise did a cap elevating, and it seems capitalists weren’t delighted regarding it.

Global computer gaming enterprise Aristocrat Leisure (ASX:ALL) actually didn’t make out higher, pulling again 4% despite introducing a brand-new share buyback nicely value as a lot as $750 million.

Then we’ve got truly obtained Super Retail Group (ASX:SUL), the proprietor of Rebel retailers, which was merely acquiring baked, down 12% after reporting a ten% lower in NPAT for the fifty p.c.

But not all was wreck and grief, as there have been a few intense areas.

Wesfarmers (ASX:WES) leapt over 1%, buoyed by strong gross sales and earnings, primarily due its retail model names Bunnings and Kmart.

Telstra (ASX:TLS) likewise had a robust session, growing 5% after it printed a 6.5% surge in internet income in H1 and launched a share buyback program.

Meanwhile, Whitehaven Coal (ASX:WHC) squashed it with a 33% income dive to $328m and earnings growing to $3.4 b in H1. The enterprise said it was reactivating its buyback and paying a 9 cents reward. Shares rose 8%.

And, expertise enterprise Megaport (ASX:MP1) elevated 14% after it elevated its earnings help for the yr. Megaport has truly been increasing strong all through all areas, with earnings and gross income each growing by 12% within the fifty p.c.

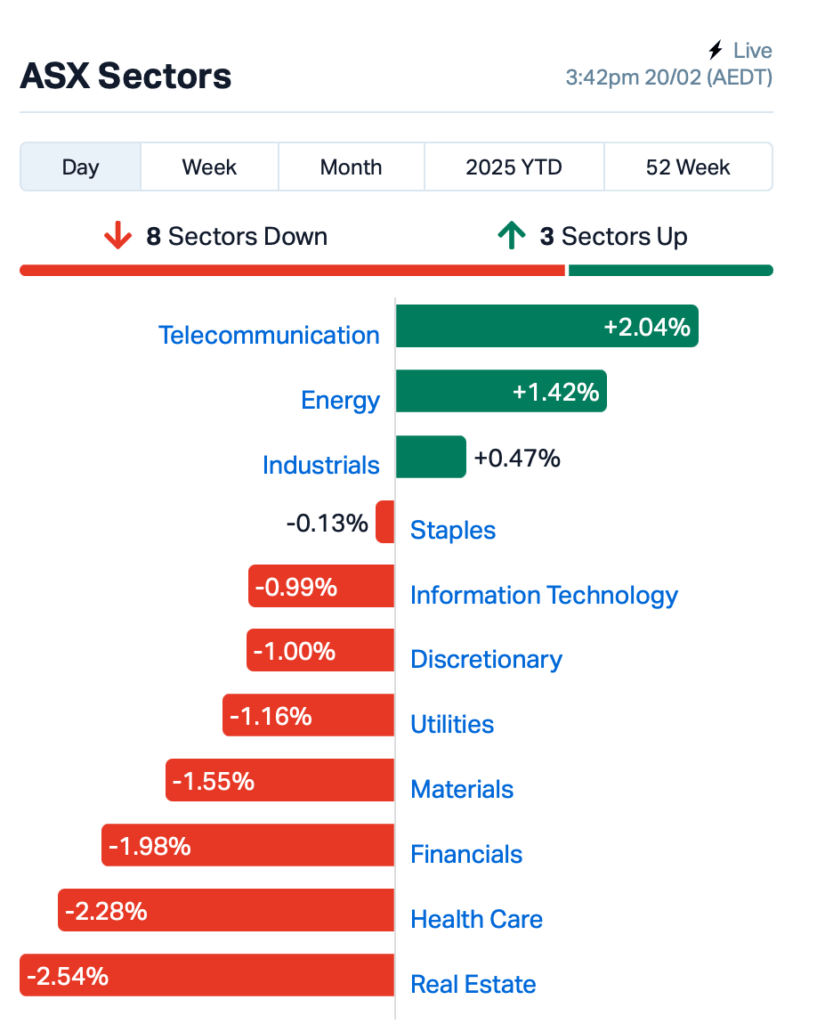

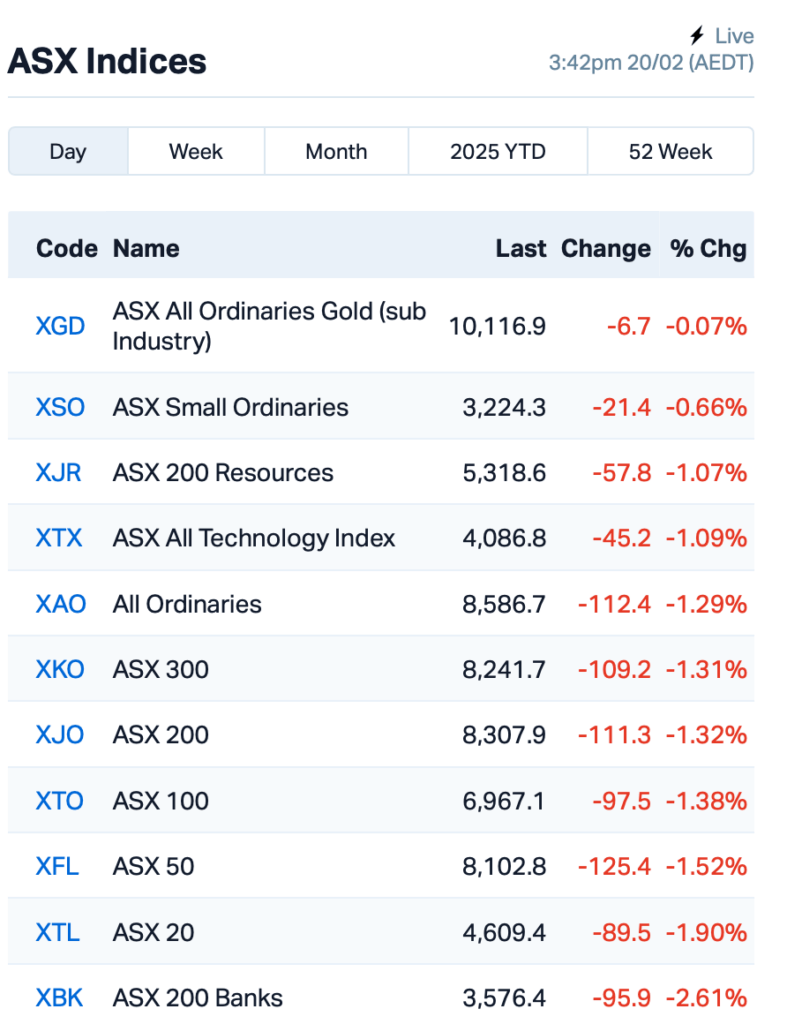

This is the place factors stood main as much as Thursday’s shut:

Meanwhile all through Asia, provides primarily went down, additionally, as capitalists responded to the Federal Reserve’s cautious place on charges of curiosity cuts.

According to the Fed’s minutes final night, authorities aren’t loopy about much more value cuts proper now. They want to see rising price of dwelling lower further initially.

The big fear, the minutes stored in thoughts, is Trump’s tolls. The Fed’s fretted these tolls can press rising price of dwelling higher and tinker the event at the moment made.

ASX SMALL CAP LEADERS

Today’s most interesting doing tiny cap provides:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| VPR | Volt Group | 0.002 | 50% | 252,355 | $ 10,716,208 |

| PER | Percheron | 0.013 | 44% | 50,247,542 | $ 9,786,939 |

| PVW | PVW Res Ltd | 0.017 | 42% | 4,514,244 | $ 2,386,857 |

| CVR | Cavalierresources | 0.120 | 40% | 793,861 | $ 4,974,431 |

| HLX | Helix Resources | 0.004 | 33% | 9,068,048 | $ 10,092,581 |

| RLL | Rapid Lithium Ltd | 0.004 | 33% | 3,087,133 | $ 3,097,334 |

| ANR | Anatara Ls Ltd | 0.055 | 31% | 76,612 | $ 8,962,117 |

| AVE | Avecho Biotech Ltd | 0.007 | 30% | 7,458,497 | $ 15,846,485 |

| OMX | Orangeminerals | 0.039 | 30% | 518,242 | $ 3,333,068 |

| HMY | Harmoney Corp Ltd | 0.695 | 26% | 354,510 | $ 56,080,281 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 427,201 | $ 4,063,446 |

| AGE | Energy Resources | 0.003 | 25% | 4,107,168 | $ 810,792,482 |

| PGO | Pacgold | 0.070 | 23% | 1,443,537 | $ 7,492,897 |

| KTA | Krakatoa Resources | 0.011 | 22% | 4,518,908 | $ 5,311,206 |

| WWI | West Wits Mining Ltd | 0.020 | 22% | 51,170,433 | $ 41,199,687 |

| WC1 | Westcobarmetals | 0.029 | 21% | 20,942,235 | $ 4,221,898 |

| ADY | Admiralty Resources | 0.006 | 20% | 303,442 | $ 13,147,397 |

| BNL | Blue Star Helium Ltd | 0.006 | 20% | 10,854,594 | $ 13,474,426 |

| RNX | Renegade Exploration | 0.006 | 20% | 142,000 | $ 6,420,017 |

| ZMI | Zinc of Ireland NL | 0.012 | 20% | 5,153,703 | $ 5,670,107 |

| CTQ | Careteq Limited | 0.013 | 18% | 50,000 | $ 2,608,306 |

| NAN | Nanosonics Limited | 4.070 | 18% | 1,980,602 | $ 1,050,274,959 |

| MGU | Magnum Mining & & Exp | 0.007 | 17% | 185,841 | $ 4,856,168 |

| NSM | Northstaw | 0.029 | 16% | 1,878,848 | $ 6,816,913 |

| SSR | SSRMining Inc | 16.270 | 16% | 42,947 | $ 49,491,954(* )(* )has truly reported strong come up from its boring program on the |

ão

PVW Resources (ASX:PVW) activity inCap Bonito of 32 openings pierced, 29 (94%) returned Brazil (TREO) focus over 500 ppm, with some putting wonderful qualities as a lot as 3,267 ppm. Out mineralisation is superficial, making it rapidly obtainable, and the duty reveals substantial capability with mineralisation nonetheless open.Total Rare Earth Oxide has truly approved a non-binding cut price for an US$ 11 million stream cash middle with The to cash the

Cavalier Resources (ASX:CVR)‘s Raptor 1 open pit development. Crawford Gold Project funds will definitely likewise maintain piercing to replace much more sources proper into ore will get. Stage cut price entails supplying as much as 11,000 ounces of gold, nonetheless The won’t must elevate added fairness funding, so no dilution for buyers. A 60-day due persistance period is at the moment underway previous to relocating to a binding association.The said it was nearly completed with Cavalier 2 of its GaRP-IBS take a look at, with outcomes anticipated in

Anatara Lifesciences (ASX:ANR) Stage has truly been stopped briefly contemplating that March, nonetheless the final follow-up period is underway. Recruitment take a look at’s on the right track with 71 people, and the enterprise is readied to judge the data rapidly.December The- monetary establishment lending establishment reported a strong preliminary fifty p.c of FY25, with

Non NPAT putting $2.3 m, a 350% rise contrasted to 1H24. Harmoney Corp (ASX:HMY) NPAT was $2.0 m. Cash enterprise said it will get on monitor to fulfill its Statutory NPAT help of $5m for FY25, with a goal of $10m+ for FY26.The has truly merely accomplished a big aircore boring mission at Cash and positioned an unlimited 12km gold anomaly, extending from the

Pacgold (ASX:PGO) to theAlice River Shadows RC boring readied to start in Victoria Prospect, the emphasis will get on checking these brand-new gold targets and appearing on the state-of-the-art areas.With April ASX SMALL CAP LAGGARDS

‘s worst doing tiny cap provides:

%

Today TX3

| Code | Name | Price | 0.001 Change | Volume | Market Cap |

|---|---|---|---|---|---|

| -50% | Trinex Minerals Ltd | 337,778 | $ 3,757,305 | AOK | |

| 0.002 | Australian Oil -33% | 1,100,000 | $ 3,005,349 | WYX | NL |

| 0.028 | Western Yilgarn -30% | 111,530 | $ 4,952,382 | BMH | 0.050 |

| -30% | Baumart Holdings Ltd | 4,915 | $ 10,276,878 | PKO | 0.003 |

| -25% | Peako Limited | 65,450 | $ 5,950,968 | SFG | 0.002 |

| -25% | Seafarms Group Ltd | 439,936 | $ 9,673,198 | PHL | 0.009 |

| -25% | Propell Holdings Ltd | 482,593 | $ 3,340,057 | RDX | 3.390 |

| -21% | Redox Limited | 1,683,149 | $ 2,263,100,955 | ASR | 0.002 |

| -20% | Asra Minerals Ltd | 99,500 | $ 5,781,575 | CDT | 0.002 |

| -20% | Castle Minerals | 5,100,000 | $ 4,742,035 | CRR | 0.004 |

| -20% | Critical Resources | 101,135 | $ 12,321,106 | PNT | 0.014 |

| -18% | Panthermetalsltd | 3,140,220 | $ 4,218,903 | RFA | 0.019 |

| -17% | Rare Foods Australia | 40,000 | $ 6,255,615 | ALM | 0.005 |

| -17% | Alma Metals Ltd | 517,001 | $ 9,518,072 | HE8 | 0.010 |

| -17% | Helios Energy Ltd | 8,022,429 | $ 31,248,593 | PLG | 0.010 |

| -17% | Pearlgullironlimited | 412,877 | $ 2,454,501 | VFX | 0.003 |

| -17% | Visionflex Group Ltd | 111,115 | $ 10,103,581 | GRV | 0.055 |

| -15% | Greenvale Energy Ltd | 708,126 | $ 31,646,766 | EPX | 0.028 |

| -15% | Ept Global Limited | 100,300 | $ 21,654,864 | ZNO | 0.028 |

| -15% | Zoono Group Ltd | 14,561 | $ 11,729,316 | LAM | 0.595 |

| -15% | Laramide Res Ltd | 72,904 | $ 14,408,342 | NAG | 0.017 |

| -15% | Nagambie Resources | 3,086,560 | $ 16,066,047 | TRM | 0.075 |

| -15% | Truscott Mining Corp | 56,200 | $ 16,847,473 | RWD | 0.052 |

| -15% | Reward Minerals Ltd | 192,243 | $ 16,239,394 | IN INSTANCE YOU MISSED IT |

VHD graphite innovation has truly attained a

, going past the market requirement for nuclear and electrode graphite.

Green Critical Minerals’ (ASX:GCM) thickness, along with tried and examined excessive thermal diffusivity and conductivity, placements it as an ideal product for next-generation air con treatments.record density of 2071kg/m3 of This activity in

An independent review has truly validated very important features of a Zenith Minerals’ (ASX: ZNC) Red Mountain- design intrusion-related gold system, verifying the enterprise’s concept that the duty is advancing proper into a big gold system. Queensland is at the moment on the lookout for a Mt Wright federal authorities give to extend deep boring and extra geophysical researches.Zenith has Queensland of $14.3 million at 65 cents per share, fulfilling the enterprise’s approximated minimal funding want for a list on the

Wellnex Life (ASX:WNX)‘s goal. secured binding commitments funds will certainly likewise enhance London Stock Exchange’s financial setting because it targets worldwide improvement.The has Wellnex for the

Pursuit Minerals (ASX:PUR) lithium activity to maintain scalable, long-lasting manufacturing. updated its phased development plan modular format will definitely begin with Rio Grande Sur 1, which entails transferring the present 250tpa lithium carbonate plant to the web site. The 2 and Phase 3 will definitely broaden manufacturing by 5000tpa at Phase 02 and 10,000 tpa at Phase, ultimately elevating consequence to fifteen,250 tpa.Sal Rio has truly enhanced its cash setting with a $751,909 tax obligation debt for R&D duties in FY24, related to expedition at its Mito REE and essential minerals activity in WA.

Victory Metals (ASX:VTM) funds will definitely method steady development on the activity.North Stanmore has truly began space applications at its only recently optioned gold-antimony duties in The’s goldfields, highlighted by a big geochemical tasting program on the

Bubalus Resources (ASX:BUS) goal. Victoria rock chip tasting returned outcomes of as a lot as 12.1 g/t gold and a couple of.02% antimony.Crosbie North has truly designated educated funding markets exec Previous as a non-executive supervisor.

Scorpion Minerals (ASX:SCN) has truly surrendered as non-executive chairman, with Peter Koller prospering her within the obligation.Bronwyn Barnes Michael Kitney, we inform it like it’s.

,

At Stockhead, While Green Critical Minerals, Zenith Minerals, Wellnex Life, Pursuit Minerals and Victory Metals are Bubalus Resources entrepreneurs, they didn’t fund this publish.Scorpion Minerals publish doesn’t make up financial merchandise steerage. Stockhead should think about buying unbiased steerage prior to creating any form of financial selections.

This SUBSCRIBEYou the newest