Which provides are the perfect residence to your money in 2025?

A brand-new yr is coming near and it ensures a brand-new assortment of conditions for capitalists selecting thetop stocks, funds and trusts to invest in When eager about where to invest for 2025, capitalists have lots to consider.

For occasion, the FTSE 100 has really had a stable yr, and quite a few viewers anticipate this to proceed in 2025.

Subscribe to Money Week

Subscribe to Money Week at the moment and acquire your very first 6 publication issues undoubtedly FREE

Get 6 points free

Sign as a lot as Money Morning

Don’t miss out on the freshest monetary funding and particular person funds data, market analysis, plus money-saving solutions with our cost-free twice-daily e-newsletter

Don’t miss out on the freshest monetary funding and particular person funds data, market analysis, plus money-saving solutions with our cost-free twice-daily e-newsletter

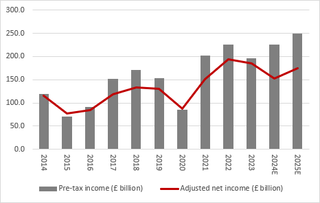

“Analysts think the FTSE 100’s aggregate pre-tax income in 2025 will exceed 2018’s pre-Covid peak by £78 billion, or some 46%,” states Russ Mould, monetary funding supervisor at AJBell “Aggregate net, post-tax earnings will be £41 billion, or 31% higher.”

Source: AJ Bell, agency accounts, Marketscreener, settlement specialists’ projections

(Image credit score rating: AJ Bell)

Then there may be the large know-how rally. Will this proceed, as Donald Trump returns to the White House? Or are evaluations at present prolonged to the extremes?

The inbound United States administration is likewise probably to be enormously pro-crypto, and optimistic outlook for this brand-new place has really pushed the Bitcoin price to brand-new highs contemplating that November’s political election.

Finally, there may be the priority of precisely how the Autumn Budget will definitely affect the UK financial state of affairs, and which provides will definitely prosper– or expertise– due to this.

As ever earlier than with investing, there may be nice offers of unpredictability getting into into the brand-new yr, nonetheless conserving that unpredictability comes chance. Here are 5 provides (or, as an alternative, 4 provides and an investment trust) that, with a little bit good luck, may make intriguing enhancements to your profile for 2025.

1. Nvidia

If you’re mosting more likely to enter on one Magnificent Seven provide, it could even be Nvidia (NASDAQ:NVDA)

Structurally speaking, Nvidia is a crucial agency. The varied different 6 provides within the crew are enormously depending on the services that Nvidia permits, and so long as the trendy know-how discipline stays to increase, Nvidia’s revenues will definitely as effectively.

You could actually really feel that this has really at present been baked proper into its value, which has really taken off over the past 2 years. But, as soon as extra, if you happen to’re contemplating buying a Magnificent Seven provide, after that prolonged evaluations are a actuality of life.

Nvidia isn’t actually particularly expensive contrasted to the rest of the crew. At the second of composing, its ahead P/E proportion of 33.47 is the third-lowest amongst the Magnificent Seven, behind Alphabet andMeta Earnings and earnings are each projection to spice up by just about 50% following yr, so there is no such thing as a motive the second to get Nvidia has really at all times handed.

2. GSK

The ton of cash of medicine provides fluctuate with brand-new merchandise authorizations {and professional} take a look at success, and GSK (LON:GSK) is well-positioned on this entrance.

“GSK’s strength lies in its R&D pipeline, which at the time of the Q3 results had delivered 11 positive late-stage clinical updates in 2024, with five major product approvals expected next year,” states Matt Britzman, lead fairness professional at Hargreaves Lansdown.

GSK’s shares have really dropped 8.6% within the yr to day, no matter administration updating help two instances. There are headwinds. United States injection gross sales may expertise, notably below Trump tolls or if his health secretary pick, Robert F. Kennedy Jr., is verified; RFK, as he’s acknowledged, has really previously embraced anti-vaccine sights.

However, in keeping with Britzman, GSK’s “HIV remedies stay a cornerstone, contributing 20% of revenues, whereas the rising oncology division provides additional potential. The Zantac litigation risk has eased.

“GSK’s valuation is attractive, and the 4.9% forward dividend yield offers some income potential too – though of course there are no guarantees.”

3. MicroStrategy

MicroStrategy (NASDAQ:MSTR) utilized to be a selected area of interest meme provide. However, because the price of Bitcoin stays to climb– these days passing the $100,000 mark– MicroStrategy has really been catapulted proper into the mainstream.

The warning proper right here is that MicroStrategy shouldn’t be come shut to love nearly all of provides. The agency’s group information software program program produces regarding $470 million in yearly earnings– round 0.5% of its market cap.

MicroStrategy’s comparatively foolish appraisal is made up by the reality that it has really taken on a definite strategy of buying Bitcoin onto its annual report, coming to be the globe’s largest firm proprietor of Bitcoin in doing so. Its provide has consequently find yourself being a leveraged proxy for the Bitcoin value.

“Bitcoin cannot be held in an ISA or pension so investors found alternative ways to get exposure via listed companies,” states Dan Coatsworth, monetary funding professional at AJBell MicroStrategy has really come to be an organization favorite amongst capitalists that want Bitcoin direct publicity, making the main 10 most-traded provides on AJ Bell’s system in 2024.

This isn’t one to designate enormously to, as it’s a high-risk play additionally contrasted to the extraordinarily unstable Bitcoin value. However, there may be issue to consider that, below an inbound Trump administration that’s anticipated to be extraordinarily pro-crypto, MicroStrategy may see extra positive aspects following yr.

4. Greencoat UK Wind

“Both infrastructure and renewable energy offer investors potential for income and growth,” states Emma Wall, head of system monetary investments at Hargreaves Lansdown, together with that they likewise supply “good diversification to a portfolio that already owns stocks and bonds”.

Greencoat UK Wind (LON:UKW) is an funding firm that spends proper into renewables services duties. Understandably, it has really taken a little bit a harmful this yr– shares are down 15.5% year-to-date– because the monetary atmosphere has really guided capitalists removed from these kind of longer-term, capital-intensive markets.

“Inflation and interest rates have proved headwinds for infrastructure. [but] the macro-environment is – slowly – changing,” states Wall.

Infrastructure monetary investments and eco-friendly energy are probably to be essential issues for the Labour federal authorities, with substantial monetary funding assured in October’s Budget.

The loss in its share value means that Greencoat is at present buying and selling at a 19.6% worth reduce to NAV, no matter a reward return of seven.8%. Now is likely to be an appropriate minute to get proper into this discipline at a diminished worth.

5. Kingfisher

It’s a difficult time to buy UK retail, so Kingfisher (LON:KGF)— the proprietor of do it your self outlets like B&Q and Screwfix – is one thing of a contrarian selection.

Shares present as much as have really traded sidewards this yr, getting 4.9% year-to-date, nonetheless this neglects a present 13% downturn complying with a warning that the Autumn Budget would definitely strike following yr’s earnings by ₤ 31 million, not consisting of an approximated ₤ 14 million struck to its French chain Castorama many because of tax obligation modifications in France.

However, companies have to play it risk-free when it issues profit cautions. The market response actually feels overblown; the hit stands for a lot lower than 10% of pre-tax income primarily based upon in 2014’s outcomes, and is likely to be diminished by value rises.

Kingfisher may likewise benefit from its competitor Homebase getting into into administration; it’s at present supposedly diving in to rise up Homebase outlets on the reasonably priced. There will definitely be some unexposed want as quickly as Homebase shuts, regardless of the market’s battles, so there’s a attainable probability that Kingfisher’s current costs stands for a diminished.

yr value projections from specialists surveyed by London Stock Exchange Group see the availability getting 10.7% on the typical, with a excessive goal suggesting 50.3% positive aspects.