IN a cost-of-living catastrophe the place all our funds rising dramatically, tens of tens of millions of households don’t receives a fee adequate to dwell comfortably.

But the great info is that over 15,000 employers have signed as a lot because the Real Living Wage.

This implies that they voluntarily pay all of their workers larger than the approved minimal diploma.

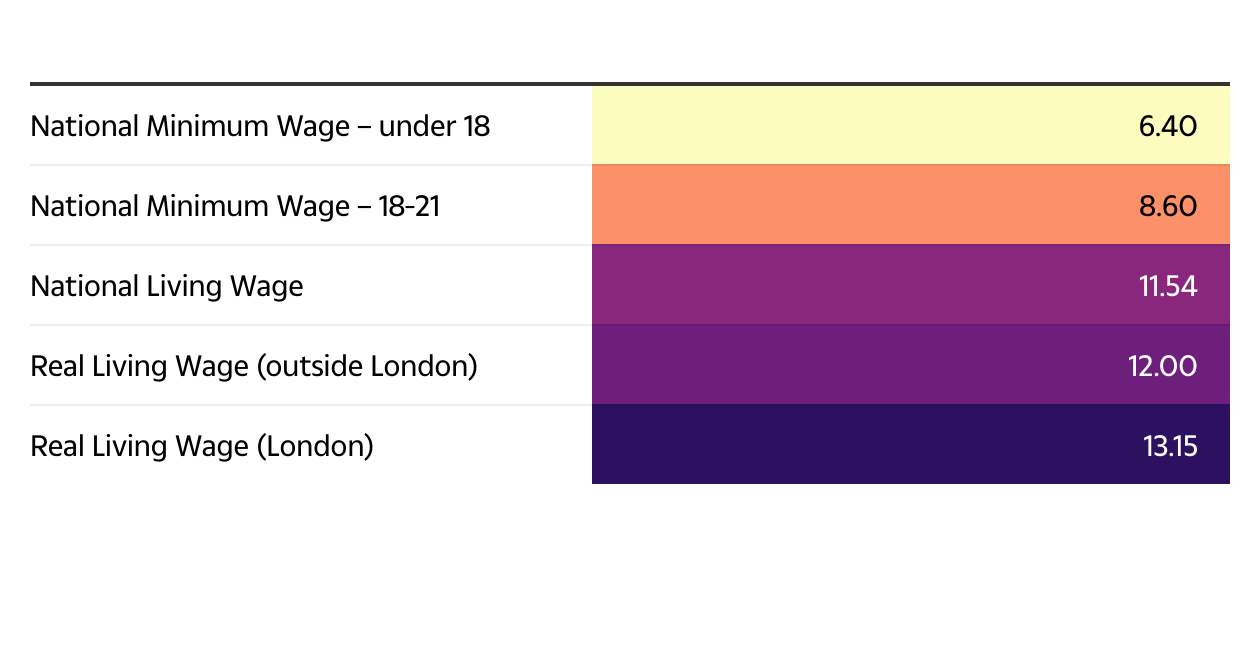

The Real Living Wage, which is calculated based mostly totally on the value of a basket of household objects and suppliers, is £12 an hour exterior of London and £13.15 an hour throughout the Capital.

It’s presupposed to be larger than the approved requirement as a result of it elements in that exact costs are larger than this.

By distinction, the government-set National Minimum Wage, the minimal pay-per-hour for workers aged between 18 and 21, is presently £8.60 an hour.

Workers who’re under 18 solely have to be paid £6.40 an hour, as do apprentices.

Once a worker turns 21, they legally have to be paid the National Living wage, which is £11.54 an hour.

But that’s nonetheless £1,092 a 12 months decrease than a worker on the true Living Wage would earn, and £3,334.5 decrease than a worker on the London wage would get.

How is the Real Living Wage calculated

The prices are calculated yearly by think-tank The Resolution Foundation and overseen by the Living Wage Commission, based mostly totally on the best obtainable proof about dwelling necessities in London and the UK.

It makes use of a public session approach known as MIS to inform the pace. MIS asks groups to ascertain what of us need to have the flexibility to afford at the least.

This is fed proper right into a calculation of what any individual should earn as a full-time wage, which is then reworked to an hourly cost.

Living costs are so much larger in London than within the the rest of the UK , which is why the London Living Wage is larger than the UK cost.

Rent is the primary dwelling worth that causes the differential between the two prices however it absolutely moreover takes into consideration childcare, journey costs, meals and household bills.

Everything it’s advisable to know regarding the latest minimal wage modifications

Who pays the Real Living Wage

The Real Living Wage shouldn’t be a government-set wage cost, so firms don’t should pay it. Any firms that are paying it accomplish that voluntarily.

The Real Living Wage Foundation says that there are over 15,000 Living Wage employers, along with half of the FTSE 100, and household names similar to Lush, Aviva, Timpson, Ikea and Liverpool Football Club.

There are moreover 1000’s of small firms that choose to pay it.

The itemizing of firms throughout the FTSE 100 that pay it are:

- 3i Group

- Admiral Group PLC

- AstraZeneca

- Auto Trader

- Aviva

- BAE Systems

- Barratt Development

- Barclays

- Beazley

- BP

- Burberry

- Convatec

- Croda

- Diageo

- Experian

- Glencore

- GSK

- Haleon

- Hargreaves Lansdown

- HSBC

- Informa

- Intermediate Capital Group (ICG)

- Intertek

- Legal and General

- Lloyds Banking Group

- London Stock Exchange

- M&G

- National Grid

- NatWest Group

- Pearson

- Persimmon

- Reckitt

- RELX Group

- Rightmove

- Sage

- Schroders

- SEGRO Plc

- Severn Trent

- Smiths

- Smith and Nephew

- SSE

- Standard Chartered

- Taylor Wimpey

- Unilever

- Unite Group PLC

- United Utilities

- Vistry Group

- Vodafone

- WPP

If you must uncover out whether or not or not a particular employer is signed as a lot because the wage scheme, you might discover out just by typing the company establish into the Living Wage Foundation search tool.

How the approved National Minimum Wage and Living Wages are altering

The Labour authorities is making modifications to the easiest way the nationwide minimal wage is about, in a switch that might see tens of tens of millions get a pay rise.

It’s first step was to overhaul the remit of the Low Pay Commission (LPC).

The modifications indicate that for the first time, the neutral physique will take the cost of living into consideration when it makes future ideas to authorities on the minimal wage.

In the election, Labour moreover promised to remove the “discriminatory age bands to ensure every adult worker benefits”.

However, in July, the Business and Trade Secretary and Deputy Prime Minister instructed the LPC to slender the outlet between the minimal wage cost for 18–20-year-olds and the National Living Wage.

The authorities said that this could be step one within the course of reaching a single grownup cost.

Finally, the federal authorities promised to work with the Single Enforcement Body and HMRC and assure they’ve the powers to ensure an actual dwelling wage is appropriately enforced, along with penalties for non-compliance. So far, steps spherical this haven’t been launched.

Chancellor Rachel Reeves said: “Economic development is our first mission, and we are going to do every little thing we are able to to make sure good jobs for working individuals. But for too lengthy, too many individuals are out of labor or not incomes sufficient.

“The new LPC remit is an important first step in getting people into work and keeping people in work, essential for growing our economy, rebuilding Britain and making everyone better off”.

When was the minimal wage launched?

THE first National Minimum Wage was put in place in 1998 by the Labour authorities.

It initially utilized to workers aged 22 and over, and there was a separate cost for these aged 18-21.

A separate cost for 16-17-year-olds was launched in 2004, and in 2010, 21-year-olds grew to grow to be eligible for the grownup cost of the National Minimum Wage.

The cost is about by the Government yearly based mostly totally on ideas by the Low Pay Commission (LPC).