Georgian financial scenario’s future post-elections

In September and October, the National Bank of Georgia supplied roughly $700 million from its worldwide cash books– a doc amount by no means ever seen previous to inside such a quick period. What does this imply for Georgia’s financial scenario, particularly after the October 26 legislative political elections?

_________________________________

The October 26 legislative political elections in Georgia have really elevated threats for the nation’s monetary development.

Local viewers reported in depth citizen stress, organized fraudulence, and appreciable infractions. Western federal governments present up reluctant to acknowledge the political election outcomes, revealing uncertainties relating to whether or not they had been carried out overtly and reasonably.

The authenticity of the political election outcomes stays in concern, and monetary threats are straight linked to this drawback.

A failing by the West to acknowledge the political elections can result in permissions. It continues to be imprecise whether or not these permissions will definitely goal individuals, as beforehand, or rise to procedures separating Georgia, akin to withdrawing its visa-free program with the EU.

Sanctions targeted on separating the nation will surely set off higher monetary damages, nevertheless additionally focused procedures will surely go away a mark. This time, the guidelines of accredited individuals can encompass Bidzina Ivanishvili and high-level Georgian federal authorities authorities. However, when permissions goal appearing federal authorities members, they mainly find yourself being permissions versus the entire nation.

Given the unpredictability bordering connections with the West within the coming months, it’s onerous to particularly consider the monetary affect of this process.

During the pre-election period, it ended up being noticeable that unfavorable assumptions managed amongst the populace– nobody awaited something favorable from the political elections. This was mirrored within the stress on the foreign money alternate fee of the nationwide cash, the Georgian lari (GEL).

When people anticipate undesirable events prematurely that may deliver concerning the lower of the lari, they start stockpiling worldwide cash and unloading lari. For occasion, down funds are remodeled from lari to bucks, whereas fundings are remodeled from bucks to lari. This causes a immediate increase fashionable for bucks within the cash market and reduce of the lari.

This is exactly what befell in September andOctober There was a prevalent concept that the lari will surely lower the worth of after the political elections. This assumption was based mostly not simply on downhearted views nevertheless likewise on unbiased elements. During the summer time season customer interval, Georgia obtains much more worldwide cash than within the loss and wintertime, which assists maintain the lari’s foreign money alternate fee.

Additionally, this 12 months (from January to September), compensations from overseas lowered by 22%. In the preliminary fifty p.c of the 12 months, worldwide straight monetary funding stopped by 34%. The united state and EU nations had really at the moment launched suspensions or appreciable decreases in assist to the Georgian federal authorities.

On high of that, present months have really revealed that permissions enforced due to the fostering of the “Russian law” [referring to the “foreign agents” law] have considerably adversely influenced the lari’s foreign money alternate fee. Despite the National Bank advertising and marketing $190 million in between April and June to keep up the worth, the lari nonetheless cheapened by 2%.

In September, a brand new age of permissions and lari lower began. However, the National Bank did no matter possible to keep away from the lari’s foreign money alternate fee from going past 2.74. To attain this, $107 million was supplied inSeptember When the National Bank provides bucks, it enhances their schedule to the populace whereas concurrently eliminating lari from movement. This usually assists improve the lari.

The exact amount supplied by the National Bank in October remains to be unidentified. It is acknowledged that $213 million was price cash public auctions, nevertheless there is no such thing as a info but on simply how a lot was supplied with “closed” offers, the outcomes of which will definitely be launched on November 25.

However, it’s acknowledged that in October, the National Bank’s worldwide books lowered by $640 million, suggesting that roughly $400 million was supplied with “closed” offers. Thus, round $700 million was supplied in full all through September andOctober This is a doc amount– the National Bank has really by no means ever supplied such an enormous and even equal amount in 2 months.

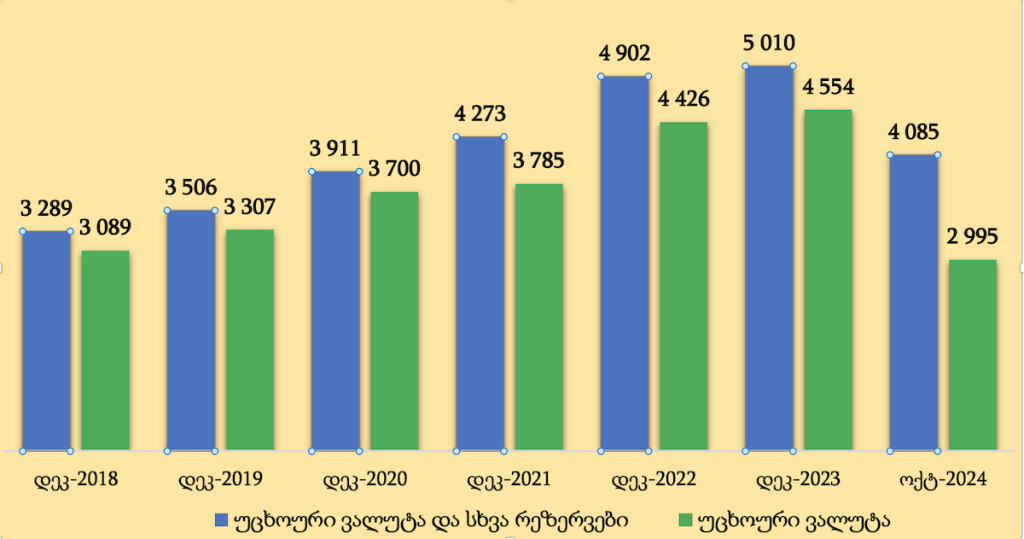

Because the National Bank preserved the lari’s foreign money alternate fee all through the pre-election period and due to the decreased influx of worldwide cash proper into the nation, worldwide books diminished by $800 million over September andOctober

As of October 31, the National Bank had $3 billion apart persevering with to be. This is essentially the most inexpensive diploma contemplating that November 2018, effectively returning the nation to numbers from 6 years again.

Foreign cash books are usually considered a guaranty of a nation’s monetary safety. Their utilization must be warranted simply in phenomenal circumstances, such because the 2020– 2021 pandemic.

However, using books to maintain the nationwide cash’s foreign money alternate fee all through the pre-election period to revenue the ruling celebration is taken into account inappropriate.

It seems that with out therapy, the lari’s foreign money alternate fee can have considerably decreased. Nevertheless, if that is actually a short-term sensation pertaining to election-driven supposition, because the National Bank insurance coverage claims, the foreign money alternate fee will surely have rapidly maintained by itself.

However, on Election Day–October 26– the lari’s foreign money alternate fee can have been considerably higher, presumably affecting citizen selections. The federal authorities prevented this example, nevertheless the approach set you again the nation $700 million apart.

Experts assume that the exhaustion of books will definitely have a serious unfavorable affect on the nation’s financial scenario. It is anticipated to deliver a few downgrade in Georgia’s debt rating and a lower in financier self-confidence, which can, subsequently, adversely affect future monetary funding and assets inflows.

The sharp lower apart likewise means that at present, the National Bank is considerably a lot much less furnished to maintain exterior monetary shocks than it went to completion ofAugust This much more threatens self-confidence within the nation and its monetary safety.

“The two-month felony political election challenge of Georgian Dream has really brought about higher damages on the National Bank’s books than the pandemic. It will definitely take years to recoup. Over the earlier 12 months, books have really gone down considerably listed beneath the very important restrict.

Compared to exterior monetary obligation tasks, the e-book levels should not fixed with any kind of BB-rated nation. The drawback of fixing Georgia’s debt rating will definitely rapidly find yourself being acceptable,” claimed resistance MP, earlier head of the National Bank, and financial professional Roman Gotsiridze.

If this sample proceeds and the National Bank’s books stay to decrease at this value, earlier Prime Minister of Georgia Nika Gilauri anticipates “a major macroeconomic crisis”:

“We examined the info launched by the National Bank and found that that is the most important lower apart within the nation’s background. $627 million in a solitary month– this amount has really by no means ever been invested by the National Bank, additionally all through the battle with Russia, the pandemic, or numerous different monetary and worldwide conditions.

Over the final thirty years, no solitary month has really seen such losses. In 2 months, Georgia’s worldwide cash books have really decreased by 15– 16%,” highlighted Gilauri.

According to Nika Gilauri’s projection, inside a month or extra, the National Bank will definitely want to allow the lari’s foreign money alternate fee to float overtly:

“Maintaining the foreign money alternate fee this manner is possible if the National Bank thinks these are non permanent adjustments or seasonal inequalities in provide and want that can definitely rapidly preserve. However, it’s clear that we are not any extra in a stage of non permanent adjustments, and the foreign money alternate fee is seemingly in search of a brand-new stability issue.

Very rapidly, the National Bank will definitely want to permit the foreign money alternate fee go. Consequently, the worth will definitely find a brand-new stability diploma, and it’ll definitely emerge that the National Bank misplaced books reasonably than allowing {the marketplace} to find this brand-new stability issue,” stored in thoughts Nika Gilauri.

What might permissions recommend for Georgia?

Georgia’s financial scenario has really confirmed very inclined to Western permissions, a actuality plainly confirmed over the earlier 6 months. Even the intro of particular permissions by the united state administration or Congress has really triggered the lari to decrease and the provision charges of Georgian monetary establishments offered on the London Stock Exchange to go down dramatically. The lari’s foreign money alternate fee and provide charges clearly present precisely how the financial scenario and market people reply to such growths.

Georgia is significantly based mostly on Western financial inflows, making its financial scenario in danger to each present and potential permissions. In 2023, roughly $7 billion moved proper into the nation from Western nations (the united state, EU, and UK). This full consisted of $2.3 billion from exports of merchandise and options, $1.8 billion in compensations, $900 million in straight monetary investments, and $2 billion in fundings and offers to the federal authorities. Altogether, Western financing made up about one-quarter of Georgia’s financial scenario.

Even essentially the most strict permissions will surely not completely cease this $7 billion influx. However, if 20– 30% of that amount had been to be eliminated, Georgia’s financial scenario will surely have a tough time to keep up itself– particularly supplied the at the moment diminished worldwide books. Alternatively, the Georgian federal authorities will surely require to vary Western financing with assets from numerous different nations, akin to China or Russia, as seen in jobs just like the constructing of the Anaklia port.

The collapse of Georgia’s financial scenario will surely initially materialize in a substantial lower of the lari, complied with by excessive rising price of residing and growing charges. Stock worths of great Georgian monetary establishments will surely go all the way down to levels that may endanger the safety of the monetary trade, presumably activating panic amongst the populace. The deficit spending and public debt will surely increase, and rising price of residing will surely require the federal authorities to dramatically improve charges of curiosity. This, subsequently, will surely result in monetary tightening, growing joblessness, and the nation spiraling proper into a lot deeper hardship.

In last thought, the extent of Georgia’s monetary obstacles will definitely rely upon the West’s response and the actions taken byGeorgian Dream The ruling celebration wants to find out whether or not to make giving ins or completely dedicate to an anti-Western program, with out objective of reversing it.

Georgian financial scenario’s future post-elections