I’m an Indian workers member in an MNC detailed in London inventory market. My enterprise expanded workers member provide selection technique in 2019 to day and I signed up for it. Kindly enable me acknowledge simply how you can decide the tax obligation positive aspects or loss from the sale of such shares detailed in worldwide alternate. They have truly subtracted alternate deal tax obligations whereas buying shares as properly. For the profit shares they put aside, my organisation has truly subtracted TDS primarily based on piece costs appropriate in India revealing it as income.

Arun

Shares which aren’t detailed in an recognized inventory market in India are handled as “unlisted shares” for the perform of calculation of sources positive aspects below the Income- tax obligation Act, 1961. Accordingly, in case you are holding the shares for a period of 24 months or much more, after that the ensuing sources achieve (if any form of) from sale of such shares will surely be pertained to lasting sources positive aspects. This will surely be taxed at 12.5 p.c if provided on or after July 23, 2024.

Section 48 of the Income- tax obligation Act, 1961, permits discount of prices which have been sustained “wholly and exclusively” for the perform of switch whereas calculating the lasting sources positive aspects. Hence, the alternate deal tax obligations billed on the market of shares may be subtracted whereas coming to taxed sources positive aspects.

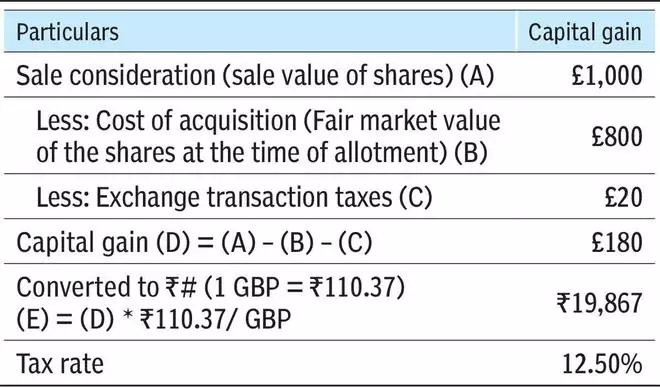

Since these offers stay in worldwide cash, the sources achieve/loss will surely require to be remodeled to INR as given in Rule 115 for the goals of sources achieve calculations. Capital achieve/loss is calculated as complies with (proven making use of instance worths):

#For the perform of image, State Bank of India telegraphic switch buying worth as on September 30, 2024, has truly been utilized in accordance with Rule 115 of the Income- tax obligation Rules, 1962, on the presumption that the shares are provided in October 2024.