The Bank of England has truly said price of curiosity would possibly boil down “gradually over time” after selecting to keep up them the identical at 5% on Thursday.

Economists assume the next reduce to loaning costs would possibly come when policymakers following fulfill in November.

Here the data firm takes a have a look at what the selection signifies and whether or not costs may be diminished as soon as extra shortly.

— What occurred to price of curiosity on Thursday?

The Bank of England’s Monetary Policy Committee (MPC) maintained the bottom charges of curiosity the identical at 5%.

Eight of the 9 members on the MPC elected to keep up costs the very same, with one participant liking to scale back them to 4.75%.

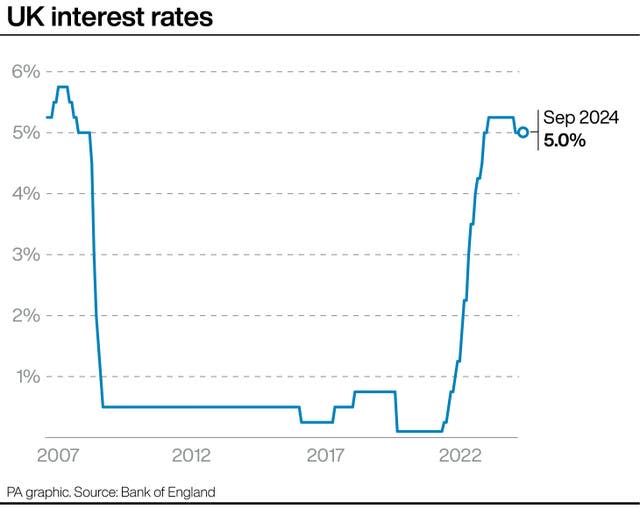

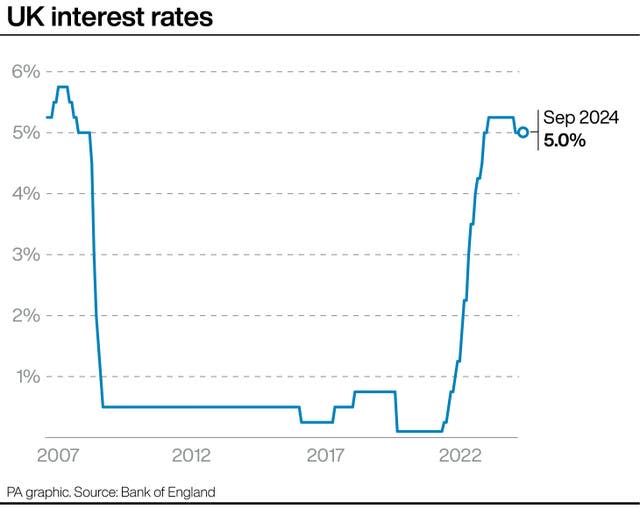

Last month, the reserve financial institution lowered costs from 5.25%– a landmark minute because it stood for the very first time that they had truly been diminished as a result of 2020.

Andrew Bailey, the Bank’s guv, said on Thursday: “The economic system has been evolving broadly as we anticipated.

“If that continues, we should be able to reduce rates gradually over time.”

— What does it actually recommend?

The base worth impacts the price that monetary establishments invoice shoppers for dwelling loans and financings.

It is made use of as a tool to handle rising price of residing all through the UK.

Hikes not too long ago have truly left dwelling mortgage costs much more than was typical for almost all of the final years.

However, dwelling mortgage costs have truly been bordering down in present weeks after the Bank began a predicted cycle of price of curiosity cuts.

Sam Richardson, substitute editor of buyer system Which? Money, said: “The Bank’s decision to hold rates where they are won’t come as a surprise, but will nevertheless still be a disappointment to homeowners coming towards the end of their fixed-term deal who would have been hoping for downward movement in the market.”

He said that whereas the present selection signifies costs are “unlikely to rise beyond the current levels, the pace of rate cuts is now likely to slow down”.

— Are charges nonetheless rising?

Yes, but at a worth that the Bank of England is much more cozy with.

Consumer Prices Index (CPI) rising price of residing hit 2% in May and June this 12 months, the Bank’s goal diploma, previous to bordering roughly 2.2% in July and August, in keeping with fundamental numbers.

However, the MPC emphasised that it required to make sure that something taxing rising price of residing was “squeezed out of the system” completely.

Mr Bailey said it’s “vital that inflation stays low”.

— When will price of curiosity boil down as soon as extra?

Some financial specialists assume that the Bank of England signified in its messaging on Thursday that possibly in a setting to scale back price of curiosity as soon as extra when the MPC following fulfills in November.

This is because of the truth that brand-new monetary data would possibly present it much more self-confidence that rising price of residing is remaining to enter the suitable directions.

Janet Mui, head of market analysis at RBC Brewin Dolphin, said: “It is fair to expect that the Bank of England will be able to keep cutting rates over the course of the next 12 to 18 months, but at a gradual and modest pace.”

“The next cut is largely expected to be November,” she said, but emphasised that the Bank’s decision-making will definitely hinge on the present monetary data.

Andrew Goodwin, major UK financial professional for Oxford Economics, said an extra worth diminished in November was “almost certain”, because the MPC has truly said that it might definitely lower costs slowly except there have been any form of shocks to the financial local weather.