It had not been prolonged in the past that just about each electrical automotive (EV) provide was skyrocketing in value. In 2021, for example, market buzz went to a excessive temperature pitch. Several EV enterprise– consisting of Rivian Automotive and Lucid Group— debuted on most of the people markets with implausible pleasure, whereas customary automotive producers had been flaunting regarding methods to strongly improve their EV schedules.

A fantastic deal has really altered ever since. And after a excessive market sell-off, it’s time to go deal shopping for. One famend EV provide particularly have to be catching your focus right this moment.

Is this famend EV provide lastly a deal?

Tesla ( NASDAQ: TSLA), the automotive producer led by the debatable Elon Musk, took {the marketplace} by twister a years again. It’s thought-about given by some right this moment, but it wanted to confirm to a cynical buyer base that EVs could be beautiful, respected, and downright fulfilling.

Its multibillion-dollar monetary investments proper into its billing community, on the similar time, stimulated worldwide want for a automotive group that, a minimal of on the time, nonetheless had a higher general possession expense than customary internal-combustion decisions.

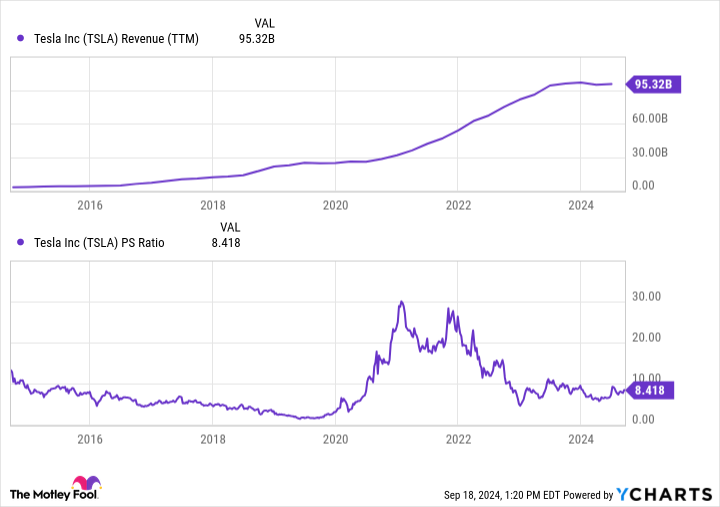

Tesla’s very early shifting firm profit offered it a stable grip in a sector that had structurally underinvested in its EV schedules. It had the workers, assets, follower base, and making talents to scale up manufacturing shortly equally as EV want started to take away. From 2018 to 2022, for instance, gross sales expanded by a powerful 357%.

But after that an level passed off. EV gross sales within the united state remained to climb up, but slower than anticipated. This positioned an enormous harm within the prices value determinations {the marketplace} had really beforehand designated to EV provides.

From 2022 to 2024, for example, Tesla’s evaluation dropped from virtually 30 instances gross sales to beneath 10 instances gross sales– a two-thirds lower over 24 months. Other EV producers like Rivian and Lucid noticed comparable evaluation decreases.

More recently, Tesla’s earnings base has not simply squashed, but has likewise decreased in particular quarters. To be affordable, the provision continues to be pretty expensive at 8.4 instances gross sales. But when you’ve got really been ready to accumulate proper into this famend EV provide, this may be your alternative. One reality particularly must get hold of you delighted.

Tesla continues to be the king of EVs

While Tesla is related to varied different group endeavors, consisting of solar energy and battery cupboard space, higher than 90% of its earnings base continues to be sure in its vehicle part. Its future will definitely be made or broken based mostly upon the success of this group, and a whole lot of its evaluation is related to its future.

It’s important to keep in mind that it nonetheless regulates a number one share of the united state EV market. Various approximates safe it with a 50% to 80% market share.

And want for EVs stays to broaden no matter a lower in projections. Over the next 5 years, residential EV gross sales are presently anticipated to broaden by higher than 10% yearly, with market earnings for EVs within the united state going past $150 billion by 2029.

Globally, EV gross sales are anticipated to cowl $1 trillion by 2029. That’s glorious data taking into account Tesla has really a forecasted 39.4% market share internationally, above the next 8 rivals included.

Put simply, the EV market continues to be Tesla’s to shed. It has much more assets, much more brand-name acknowledgment, and way more making capacity than any kind of varied different rival. And right this moment, quite a few customary automotive producers are drawing again on their EV methods, presumably enabling the enterprise to maintain its main market setting for a number of years to search out.

We may recall at 2024 as a transparent outlier in Tesla’s long-lasting growth trajectory. Sales are anticipated to lower by 8.2% this 12 months. But in 2025, specialists are anticipating a rebound, with earnings leaping by 15.8%.

Is the provision nonetheless expensive at 8.4 instances gross sales?Absolutely But its long-lasting assure continues to be undamaged, and the present evaluation is a beloved one deal contrasted to years previous.

If you depend on EVs long-term, it’s powerful to not financial institution on the present market chief, additionally if there are some near-term difficulties when driving prematurely. It will surely be a speculative wager, but financiers which have really been contemplating Tesla for a number of years whereas awaiting a pullback wants to consider a bit monetary funding. If shares stay to lower, possibly a chief risk for dollar-cost averaging.

Should you spend $1,000 in Tesla right this moment?

Before you purchase provide in Tesla, take into account this:

The Motley Fool Stock Advisor skilled group merely acknowledged what they assume are the 10 best stocks for financiers to accumulate presently … and Tesla had not been amongst them. The 10 provides that made it will possibly generate beast returns within the coming years.

Consider when Nvidia made this guidelines on April 15, 2005 … when you spent $1,000 on the time of our suggestion, you will surely have $710,860! *

Stock Advisor provides financiers with an easy-to-follow plan for achievement, consisting of help on growing a profile, regular updates from specialists, and a pair of brand-new provide decisions month-to-month. The Stock Advisor answer has higher than quadrupled the return of S&P 500 contemplating that 2002 *.

*Stock Advisor returns since September 16, 2024

Ryan Vanzo has no setting in any one of many provides identified. The Motley Fool has placements in and advisesTesla The Motley Fool has a disclosure policy.

1 No-Brainer Electric Vehicle (EV) Stock to Buy With $200 Right Now was initially launched by The Motley Fool