-

Stocks finished greater Wednesday as investors absorbed tasks information and waited for the begin of the Jackon Hole seminar.

-

Revised tasks information reveal that the economic climate included 818,000 less tasks than originally anticipated.

-

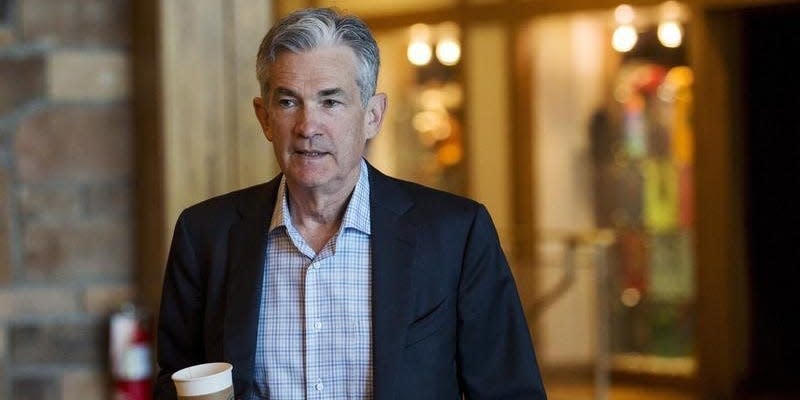

Investors are awaiting Powell to release even more assistance on Fed plan at Jackson Hole on Friday.

United States supplies acquired on Wednesday as investors waited for the begin of the Federal Reserve’s Jackson Hole financial seminar and absorbed modified tasks information from the previous year.

Major supply indexes traded greater, while Treasury returns went down via Wednesday’s session.

The Bureau of Labor Statistics released revised job figures from April 2023 via March 2024, which revealed that the United States economic climate included 818,000 less tasks throughout that duration than originally reported.

The brand-new numbers, which show a weak task market because duration, have actually boosted self-confidence that the Fed is positioned to loosen up financial plan and problem possibly steeper price cuts than formerly believed.

Markets are looking at a 39% opportunity the Fed might reduce prices 50 basis factors in September, up from much less than 30% previously today, according to the CME FedWatch tool.

“If you are in the rate cut in September camp, these data all but seal the deal on what [the] Fed needed to cut rates,” Jamie Cox, a handling companion at Harris Financial Group, claimed in a declaration.

Investors were additionally relieved by the Fed’s most current conference mins, which revealed that most of FOMC participants thought it would certainly “likely be appropriate” to start reducing rates of interest in September, as long as financial information proceeds “to come in about as expected,” the minutes claimed.

That’s substantially a lot more dovish than the tone main lenders have actually struck all year, with Fed Chair Powell formerly mentioning that the reserve bank required a lot more self-confidence that rising cost of living was back on course prior to alleviating plan.

“Still, overall the FOMC appears comfortable enough — and concerned enough — that initiating the easing cycle will help ensure that the economic backdrop, particularly the labor market, won’t deteriorate at a marked pace,” Quincy Krosby, the principal worldwide planner at LPL Financial, included.

Investors are awaiting Powell to talk at the Fed’s yearly Jackson Hole hideaway on Friday, where the reserve bank principal is anticipated to supply even more assistance on plan via completion of the year.

Here’s where United States indexes stood at the 4:00 p.m. closing bell on Wednesday:

Here’s what else is taking place today:

In assets, bonds, and crypto:

-

Oil futures went down. West Texas Intermediate petroleum dropped 1.7% to $71.93 a barrel. Brent crude, the global criteria, dropped 1.45% to $76.09.

-

Gold was up a little to $2,552 an ounce.

-

The 10-year Treasury return went down 2 basis indicate 3.795%.

-

Bitcoin leapt 3.4% to $61.563.

Read the initial post on Business Insider