Today I’m looking at Costco and Target; 2 fellow enormous field retailers. Shares of retail big Costco (EXPENSE) have truly elevated regarding 63%% over the earlier yr, whereas Target (TGT) shares are up about 39% over the very same interval. Both provides have performed effectively, nonetheless which is the significantly better chance for capitalists transferring ahead? Let’s analyze that inquiry.

I’m impartial on Costco based mostly upon its expensive appraisal. Regarding Target, I’m favorable this provide based mostly upon its economical appraisal, interesting reward return, and prolonged background of reward improvement. Additionally, sell-side specialists try Target as having considerably far more upside prematurely over the next twelve month.

The Setup

Costco is far valuable by capitalists, and really so. The provide has truly created handsome returns for its traders for a few years, to the track of nearly 900% over the earlier years. Costco is incessantly talked about as being effectively taken care of and having an eye catching service design on account of reoccuring yearly prices paid my its individuals.

Target has truly created a whole return of 224% over the earlier years. Target is adept, nonetheless it has truly significantly delayed Costco’s effectivity over the earlier ten years. However, this may produce an additional participating configuration for a monetary funding in shares of Target as we speak, as we’ll evaluation following.

Massive Gap in Valuations

While Costco is a terrific service with a stable document of effectivity, it trades at pretty a excessive quite a few now in time. Costco has an off-cycle that finishes in August, and will definitely rapidly report its This fall 2024 earnings outcomes. The enterprise trades over 50 occasions settlement 2025 earnings quotes. This overpriced quite a few fallen leaves little area for mistake transferring ahead if the enterprise dissatisfies capitalists in This fall or all through the next .

Meanwhile, Target professions at a much more smart appraisal of 14.8 x onward earnings quotes, effectively listed under Costco’s quite a few and likewise significantly listed under the S&P 500’s ( SPX) onward appraisal of 24x. One can positively make a scenario that Costco is a higher-quality service than Target based mostly upon its reoccuring subscription prices, nonetheless an appraisal 3 occasions as expensive appears like method an excessive amount of of an area.

Furthermore, no matter Costco’s credibility for prime quality, Target is a higher-margin service, with gross margins of 26.1% roughly two occasions as excessive as Costco’s gross margins of 12.5%. Target’s earnings margin of 4.2% is likewise visibly larger than Costco’s 2.8%. From my viewpoint, Target’s significantly decreased appraisal makes use of the provision far more downside protection and much more area to shock to the benefit.

Two Strong Dividend Growth Stocks

Costco is a reward provide, nonetheless its return of 0.5% is moderately insignificant. That claimed, Costco is worthy of credit standing for its stable reward improvement, having truly elevated its reward value 19 years straight.

Meanwhile, Target’s reward return is 2.9%. This is nearly 6 occasions larger than Costco’s present return, and larger than double the return for the S&P 500. Target has a much more excellent document of usually paying and increasing its reward thanCostco Target is a Dividend King that has truly enhanced its fee for a unprecedented 55 years straight.

Both companies likewise protect pretty conventional fee proportions, indicating that each rewards look risk-free for the close to future. While Costco has truly performed a fantastic activity of increasing its reward, Target’s return is significantly larger, and its common background of reward improvement can also be significantly better, which sustains my favorable sight of the provision.

Is EXPENSE Stock a Buy, According to Analysts?

Turning to Wall Street, value positive factors a Strong Buy settlement rating based mostly upon 17 Buy, 5 Hold, and no Sell scores appointed within the earlier 3 months. The typical value provide price goal of $936.25 suggests regarding 4.0% potential upside from present levels.

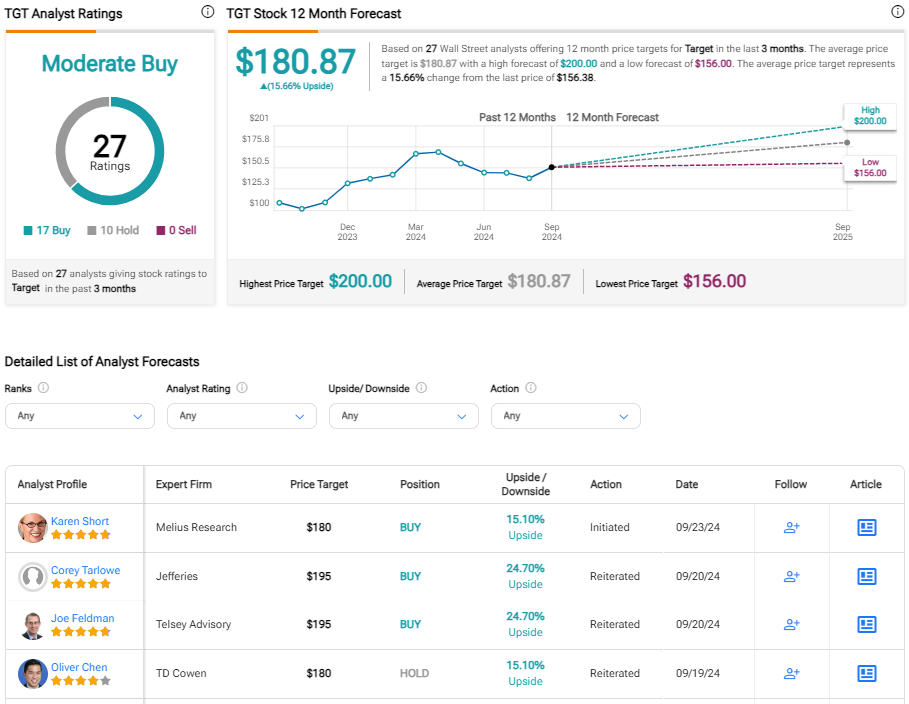

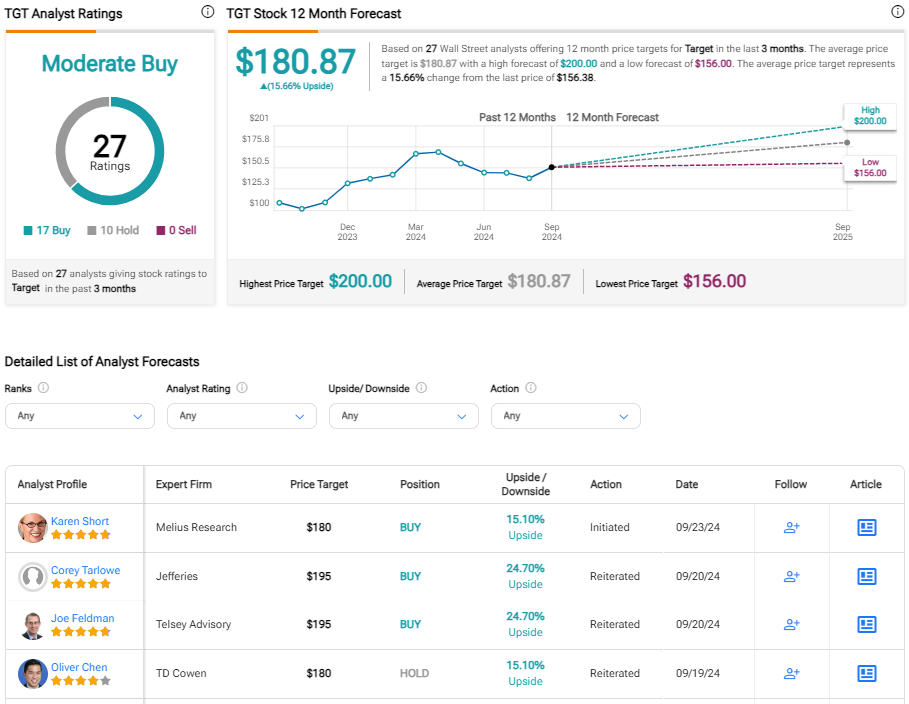

Is TGT Stock a Buy, According to Analysts?

At the very same time, TGT positive factors a Moderate Buy settlement rating based mostly upon 17 Buys, 10 Holds, and completely no Sell rating appointed within the earlier 3 months. The typical TGT provide price goal of $180.87 suggests round 16% potential upside from present levels.

Smart Choices

As you possibly can see making use of TipRanks’ Stock Comparison Tool listed under, each Costco and Target acquire Outperform scores from TipRanks’ Smart Score system.

Smart Score is a measurable provide racking up system produced by TipRanks. It gives provides a score from one to 10, based mostly upon 8 very important market facets. Scores of 8, 9, or 10 are considered akin to an Outperform rating.

Cocsto’s Outperform- comparable Smart Score of 9 goes over, nonetheless Target prevails with a perfect-10 Smart Score.

Target Stock Looks Like the Preferred Investment Choice

Costco is a terrific enterprise and has truly been a terrific entertainer for its traders over years. However, I’m impartial on shares now as this stable run of effectivity has truly despatched its appraisal over 50x onward earnings, providing the provision little margin for mistake transferring ahead.

Target professions at a much more interesting appraisal of below 15x onward earnings, makes use of a larger reward return, and for much longer background of reward improvement. I’m favorable on Target supplied its economical appraisal, interesting reward return, and 55 straight years of reward improvement. Costco is a superb provide with a reliable background of effectivity, nonetheless as we speak I try Target because the significantly better monetary funding various based mostly upon my analysis of each choices.

Disclosure